DSCR Investment Loan

DSCR Investment Loan – Finance Your Rental Property with Ease!

Grow your real estate portfolio with a DSCR (Debt Service Coverage Ratio) Investment Loan! No personal income verification needed—qualify based on your property’s rental income. Get started today with a FREE consultation!

DSCR Investment Loan – A Smarter Way to Finance Rental Properties

A DSCR (Debt Service Coverage Ratio) Investment Loan is a specialized loan designed for real estate investors. Unlike traditional mortgages that require proof of personal income, a DSCR loan focuses on the income generated by the rental property to determine eligibility. This makes it an excellent option for investors who may not have traditional income documentation but have a strong cash-flowing rental property.

How is DSCR Calculated?

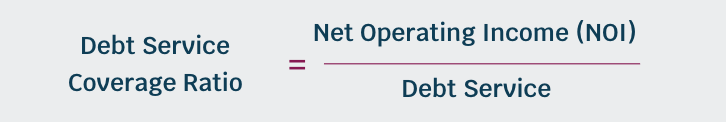

The Debt Service Coverage Ratio (DSCR) is the key factor in determining loan approval. It’s calculated as:

DSCR = Rental Income ÷ Mortgage Payment

- A DSCR of 1.0 or higher means the property generates enough income to cover the mortgage.

- A higher DSCR (1.25 or above) improves loan approval chances and may qualify for better terms.

Why Choose a DSCR Investment Loan?

✔ No Personal Income Verification – Approval is based on property income, not your W-2s or tax returns.

✔ Fast & Flexible Financing – Perfect for real estate investors looking to expand their portfolio quickly.

✔ Less Documentation Required – Avoid the paperwork burden of traditional loans.

✔ Available for Different Property Types – Single-family homes, multi-unit properties, short-term rentals, and more.

✔ No Limit on Property Count – Great for investors scaling their rental business.

How the DSCR Loan Process Works

- Get Pre-Qualified – Find out how much you can borrow.

- Select Your Investment Property – Choose a rental property that generates strong income.

- Submit Your Loan Application – Provide property details, rental income, and minimal documentation.

- Property Appraisal & DSCR Calculation – The lender verifies the property’s income potential.

- Loan Approval & Closing – Secure financing with a quick and easy closing process.

- Start Earning Rental Income!

More likely to qualify for a loan

More likely to qualify for loan and receive an offer with better terms

Lower Interest Rates

Increases your chances of lower interest rates and a higher borrowing amount